Is the Ontario student hourly wage enough for Post-Secondary students?

- Lorraine Soto

- Nov 24, 2020

- 4 min read

Updated: Dec 20, 2020

Working a part-time job has been a routine in most Post Secondary student’s lives. With many paying for personal bills while supporting their families at home, the student hourly wage of

$14.25 may not be enough.

Karolina Kujawski, a second-year college student, shares why her bi-weekly paycheques aren’t enough to make ends meet. While Karolina attends school full-time, she also works a part-time job. She works as a part-time cashier at Shoppers Drug Mart. According to Canada’s Government, under the Employment Standards Act, students in full-time studies work 20 hours a week maximum. In a recent interview with S@Y News, Karolina says, “I work roughly 20-30 hours weekly, and they know I’m in school all week”. Juggling between a full-time course load and full-time hours can be detrimental for most students. Karolina’s biggest struggle is figuring out how to make sound financial choices. She must assist her mother with bills at home. Many students do not have the luxury or privilege to have everything paid off. In Karolina’s current situation, she needs to pay for at-home bills, OSAP debt, and personal expenses (phone bill, food, transportation etc.). On average, Ontario students make the minimum wage of $14.25, and in rare scenarios, Karolina makes 25 cents over. Karolina adds, “It just does not seem possible sometimes. I’m not complaining about what needs to be paid at home, but how am I supposed to balance this and school. I can’t even get a better job without having further experience. They need to raise the hourly wage; it’s not fair to those having this much on their plate”.

The big question here is how can a full-time post-secondary student financially manage these responsibilities? Living in such a diverse part of Toronto, I witness so many small business storefronts and at-home workspaces. Scrolling through social media are several accounts showcasing small beauty businesses. Investing in yourself is what young people call it nowadays.

Arianne Joyce is a full-time University student who runs an aesthetician business called Ajoycelashes. She offers eyelash extensions and training. As a full-time student, Arianne must have an income source to support her school and personal expenses. She has not worked a field job a day in her life but earns over the minimum salary entry-level positions offer. As small businesses slowly expand, Arianne Joyce is one of the many successful owners of a self-made brand. In a late interview with S@Y News, Arianne says, “I’ve always worried that not working a regular retail or food job like everyone else my age was bad but now that I’ve invested my money to start my own business, I live comfortably”. She then adds, “Now that I don’t live with my parents anymore, lashing has helped in terms of being financially stable and responsible. I can now pay for everything on my own. Bills, appliances, and school”.

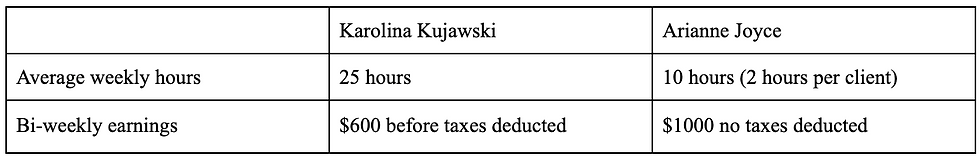

After speaking and connecting with Karolina and Arianne, I compared the individual’s earnings and hours of work per week.

The chart compares the student’s earnings/hours of work, on average. Karolina and Arianne are full-time students with similar financial responsibilities. Working a part-time job at any place, whether it be the retail or food industry, is not enough for Karolina because it is not realistic to balance a full-time course load while working full-time hours. Karolina states she roughly makes around $600 but with taxes deducted it reduces to around $522. Students like Arianne Joyce chose to invest in a beauty business and now earns 40% more than Karolina. Arianne does not work over the part-time hour requirement. Thus, she is fully capable of managing school assignments and lectures while working.

The Ontario student, hourly wage sits at $14.25 and although it has increased over the past years, everything has gone up in price. Daily living expenses such as food and rent has increased by 10%.

In the midst of all this, starting your own business is shown to be more successful. The comparison above displays the earnings two typical students make, with one small difference. One works a field job, whereas the other is a self-made business owner.

21-year-old Danae Ramirez, the owner of RMZ Lashes, started her business in 2017. She provides eyelash extension and multiple brow services, all while being an educator. With several years of hands-on experience, she became certified to train others—each trainee pays roughly $1200, depending on the class. The fee covers the overall course of lashing and brows, alongside starting supplies. As RMZ lashes offer services and training, she now has a consistent amount of clients arriving weekly at her door. In a late interview with S@Y News, she says, “I do make over the minimum average salary entry-level jobs offer”. She then adds, “It’s the best financial choice I’ve made, to quit my part-time job and invest in myself while being a student”.

As a post-secondary student, Karolina hustles her way through full-time classes and a part-time job. Many students in Ontario live alone, and although Karolina does not, she is still required to uphold financial responsibility. Whether it be a phone bill or helping your parents out with rent, students continue to worry because their bi-weekly earnings still aren’t enough.

Arianne Joyce and Danae Ramirez are now self-made bosses who earn over the minimum salary entry-level positions offer with small businesses on the rise. Being a brand owner has proven only to be a millennial trend but something more than that. With the ability to invest, become financially stable, and establishing a platform for yourself, becoming a student business owner can have many short-term and long-term benefits. Karolina shares she will not be receiving a raise anytime soon but says she’s always thought about starting a business. So the question still ponders, will students continue to work hazardously long hours or make the shift and perhaps work for themselves?

Comments